-

MTD 2022 update

Making Tax Digital (‘MTD’) is an HMRC initiative attempting to transform the UK tax system, with more regular and detailed submissions of information and payments of tax to HMRC electronically. Whilst it has been delayed several times, it aims to make tax administration more effective, efficient, and easier for taxpayers through the implementation of a…

-

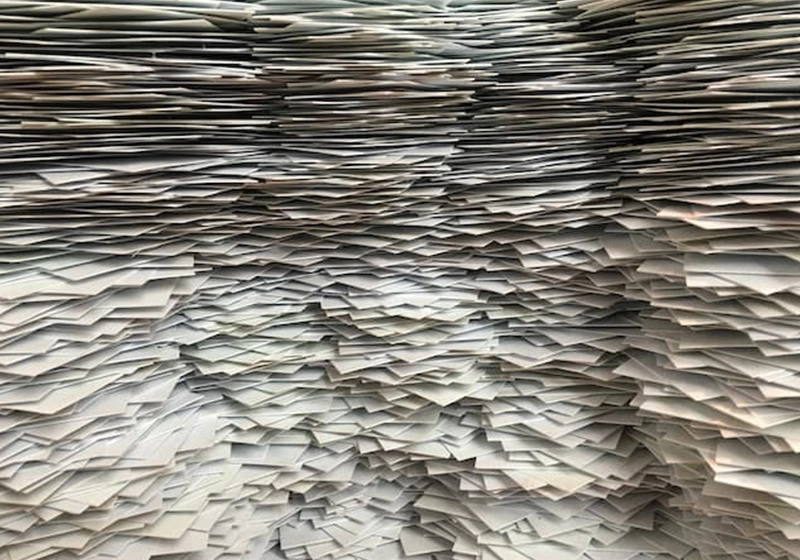

Have you Submitted your Self-Assessment Tax Return? 1.8 million haven’t…

On 25 January 2021, six days before the 31 January 2021 deadline, HMRC announced that if you are unable to meet this deadline, you will not receive a late filing penalty, as long as you file your 2019/20 tax return online by 28 February 2021. However, they encouraged people to still aim to meet this…