BUSINESS GUIDES, INSIGHTS, ADVICE & NEWS

-

Are you protected against a HMRC enquiry?

Each year HM Revenue & Customs (‘HMRC’) undertake an enormous number of tax enquiries into individuals and businesses to check they have paid the right amount of tax. Since 2010 HMRC have strengthened their approach to enquiry work by using wider powers and sophisticated software and consequently secured a record £34.1 billion of additional tax…

-

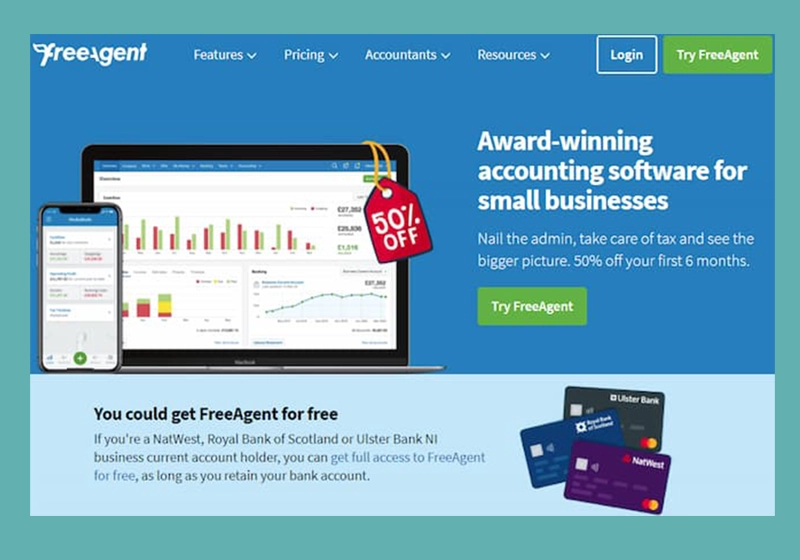

Top 10 Reasons We LOVE FreeAgent

There are lots of cloud-based accounting software solutions out there. They can be a key tool to help individuals and Small and Medium sized-enterprises (‘SMEs’) get better information to make the right decisions for their future anywhere they can find a wi-fi connection. This better information can also be available more efficiently at your fingertips.…

-

Budget 2021 – How will it affect you?

Today Rishi Sunak, the Chancellor of the Exchequer set out the Government’s tax and spending plan for the year ahead. We cover the impact from individuals, self-employed and small company owners in detail below. We have also done a quick summary, in case this is easier for you to digest. This is based on what…

-

Budget 2021 – Quick Summary

With the economy shrinking by 10% in 2020 with it forecast to rebound in 2021 by 4% and 7% in 2022. 700,000 people have lost their jobs during the pandemic, despite all the Coronavirus Support Schemes and unemployment is expected to hit 7.3% next year, although this is significantly less than the previous 11.9% predicted.…

-

VAT Domestic Reverse Charge for Construction Services Live *Today*

HMRC’s new Domestic Reverse Charge for the Construction Sector comes into force from today, 1 March 2021. As you may know from our previous blogs, it was originally planned to come into force in October 2019, until this was pushed back until October 2020 to enable more time for the sector to prepare for the…

-

Coronavirus VAT Deferral Scheme

If you deferred the VAT due on your business between 20 March 2020 and 30 June 2020, you can join the new VAT deferral payment scheme from today until 21 June 2021. As part of the Coronavirus support schemes businesses were given the opportunity to defer payment until 31 March 2021 to give them breathing…

-

Recap: Capital Gains Tax Changes

Almost 12 months ago, we posted a blog noting the changes coming in Capital Gains Tax (‘CGT’) which took effect from 6 April 2020. However, we are constantly having conversations with individuals selling residential properties who are completely unaware of the changes. We therefore thought it would useful to recap these changes, to raise awareness.…

-

Bounce Back Loans Update

As part of the Coronavirus Support Schemes, the Government introduced the Bounce Back Loan to support Small Businesses through this most difficult of times. Since the initial announcement there has been a few further improvements made here, so we wanted to make you aware of these, especially as this scheme is coming to an end…

-

IR35 ‘Soft Landing’ from 6 April 2021

Today HMRC announced that whilst the delayed IR35 changes will come into effect from 6 April 2021, there will be a ‘soft landing’ as part of their compliance strategy. Whilst many were hoping for a U-Turn or further deferral here due to the unprecedented times, it appears HMRC are looking to implement the planned changes…