How many kings have been toppled, or bloody wars fought, because of income tax?

I don’t mean that wars have been fought over income tax (though there has been the odd riot). I mean that many of history’s longest and bloodiest wars were only made possible because governments introduced levies on people’s incomes, primarily to pay for ships, weapons and men.

Ancient Greek tax rebates

This trend started in ancient Athens, which imposed the eisphora on its free citizens in times of war. However, not only would those freedom loving Athenians repeal the eisphora when the fighting was done, they also refunded their tax payers out of the spoils of war.

The people who invented the term barbarian for foreigners also imposed a monthly poll tax on anyone who didn’t have two Athenian parents; one drachma for men and half a drachma for women. Xenophobic but also progressive?

In England before the modern era, kings and parliaments tended to tax things, such as wool, land, trade, even windows. And taxes were generally raised for specific purposes like relieving the deserving poor or equipping the navy, rather than for general running costs.

Tax rebellions

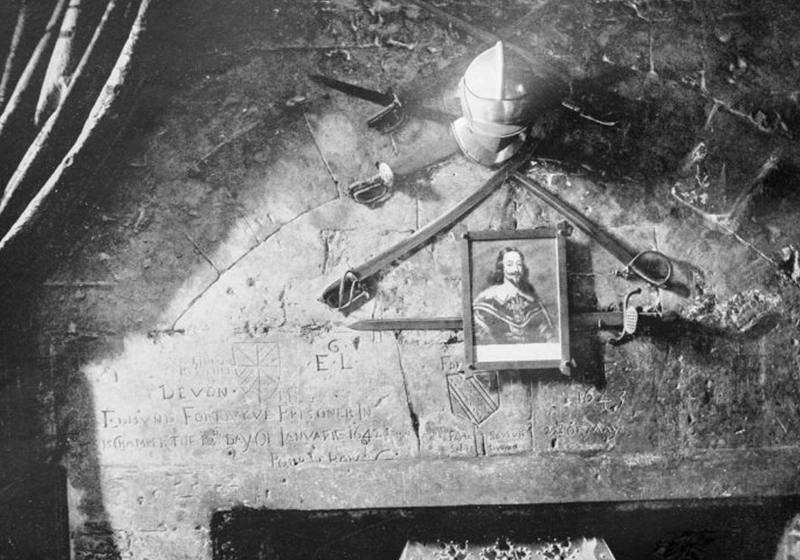

Taxation has always been controversial; King Charles I lost his head after a civil war that started as a tax-raising dispute with parliament, and we lost 13 of our North American colonies over a tea tax, but taxing personal wealth was considered too intrusive and dangerous, especially since the poll tax rebellion of 1381.

But when war comes, governments face two “taxing” problems; wars are very expensive and they disrupt trade, which means there are fewer things to tax.

A temporary tax – honest

That’s why, at the height of the Napoleonic Wars, Great Britain’s Prime Minister, William Pitt the Younger, bit the bullet and introduced income tax in 1799, purely as a temporary measure, mind.

The original income tax ranged from two old pennies in the pound (0.008%) on incomes over £60, to a maximum of 2 shillings (10%) for annual earnings of more than £200. He raised £6 million in 1799 which paid for the world’s largest navy and armies spread from the Caribbean to Egypt.

The government was true to its word and abolished the tax in 1802 when the Peace of Amiens was agreed, although it was re-established briefly from 1803 to 1816 in order to finish off Napoleon Bonaparte once and for all.

Only in 1842 was income tax as we know it introduced by Sir Robert Peel. All those great ideas for public services, like a police force and a postal service, had to be paid for somehow.

The USA followed suit in 1861 when their Congress imposed its first personal income tax, at the rate of three per cent for incomes over $800, to help pay for the American Civil War.

And there we have it; tax on income is probably here to stay, with just the occasional tweak; rates going up and down, National Insurance being introduced at the birth of the welfare state and companies being moved out of the frying pan of income tax and into the fire of corporation tax in 1965.

Need help with your tax self-assessment?

For comprehensive assistance with self-assessment tax returns, reach out to Black and White Accounting. Our team includes experienced local self-assessment accountants, and we are ready to provide the expertise you need. Call us now at 0800 140 4644 for tailored financial support.

We offer a free initial consultation and we always make sure our clients only pay the tax due.