-

The Ultimate Guide to Accounting Software and Digital Accounting

Using online accounting services and tax software can be a great way to keep track of your income, outgoings and tax owed each year, simplify returns and save you stress. However, if you’re new to running a business or haven’t had a great experience of accounting software in the past, it can be difficult to…

-

The Ultimate Guide to Accountancy for Start Ups

At the beginning a new venture, you’ve probably already spent copious hours working out how you’re going to make money – but have you considered how you’re going to manage it? Making sure your books are balanced certainly won’t bring you as much joy as your first deal, but it’s essential for keeping your start…

-

The Corporate Insolvency and Governance Act

The Corporate Insolvency and Governance Act was passed on 25 June 2020, with many measures coming into immediate effect on Friday 26 June. It aims to relax the burden on businesses during the coronavirus outbreak, providing additional flexibility and allowing corporate bodies to focus on their operations in these unprecedented circumstances. We provide more information…

-

The difference between tax evasion and tax avoidance

In light of the Coronavirus outbreak, the UK government has created many schemes to aid employees and businesses alike. From the Job Retention Scheme to business support grants, they are doing all that they can to help as much as possible during these unprecedented times. However, there are some people who have not met the…

-

Getting a Self-Employed Mortgage – Why an Accountant Makes all the Difference

Let’s not beat around the bush – getting a mortgage if you are self-employed or run your own business is hard. There are a lot of obstacles in the way of buying a property and if you are in the position where your work and your income fluctuates, then it can feel impossible to break…

-

Can I save taxes and the planet at the same time?

News stories of environmental disasters, demonstrations in central London and even the recent hot summer have made us aware of the importance of playing our part in protecting the environment. The good news is that your business may be eligible to benefit from tax relief by participating in schemes encouraging businesses to go green.

-

Case Study – Dealing with a Limited Company’s Accounting Nightmare

An accountant can get your business, and your life, back on track There’s lot to think about when starting your own business and finding the right expert business and accounting support from the beginning makes a huge difference. However, it can be even more important at the end of a business, or if things go…

-

Investing in an Accountant for a Start-Up Business

Being your own boss is an incredible experience, but it’s also really frightening, with money and cashflow at the very centre of your mind. No matter what else is going on, you will be asking yourself ‘am I going to get enough money in to pay myself?’.

-

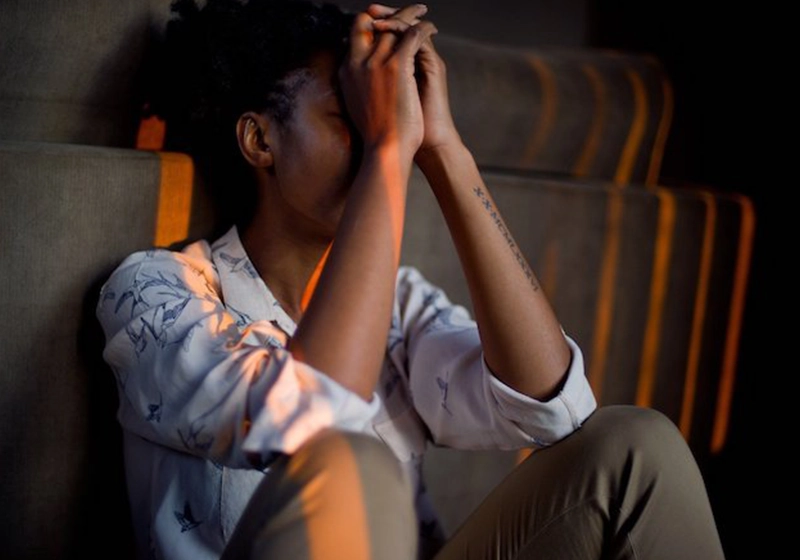

Case Study: When falling behind with the accounts starts affecting mental health

When you’re years behind in your accounts, it’s still not too late to make a fresh start We understand that for many of our clients the relationship we build goes beyond the technical accountancy service we offer. The real difference we can make is supporting them when times are challenging and giving them confidence that…

-

The Future is Here: Open Banking

In the modern world Banks have a perplexing problem; consumers want more convenience (easy ways to check their balance and make payments) at the same time as greater safety and security (of their data and finance, especially post General Data Protection Regulation (‘GDPR’)). A few changes have taken place recently as steps towards this, known…